The festivities are now a distant memory but any financial mishaps over the Christmas period sadly, cannot be left in the past.

Nothing says ‘Un-Happy New Year’ more than the arrival of a looming credit card bill that you had gladly shoved to the back of your mind while sipping on that delicious mulled wine. But such is life and reality always bites in the form of that statement you had hoped to forget.

Fear not! With a brand new year comes the chance to start over and get your finances back on track. It’s time to extend the mantra of, ‘new year new me’ beyond your physical health to include your financial health. Think of it as, ‘watching your financial waistline’. With your finances in order you will be able to enjoy life without the strain of nagging money worries.

So where should you begin on the road to financial health? Well dear readers, leave the work to us. Let us introduce you to Avantcard. Before you click off at the thought of taking on a new credit card let us be clear; this is a credit card with a significant difference.

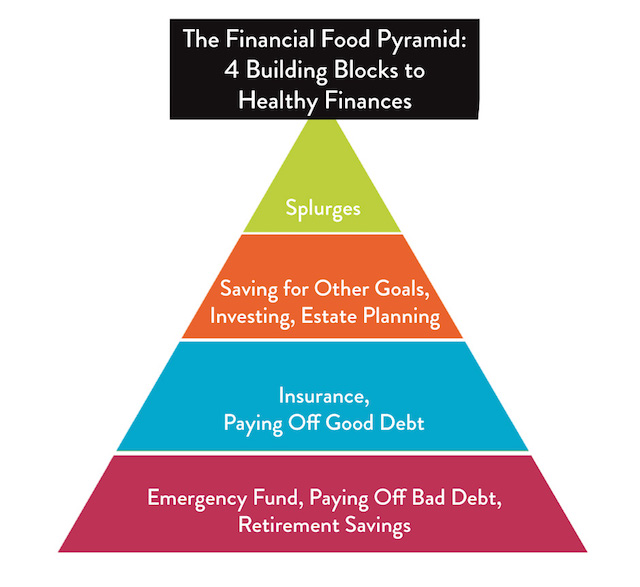

The difference is Avantcard advocate a healthy approach to spending. To begin with they recommend reviewing their financial food pyramid which shows the four building blocks to healthy finances.

The ethos is simple; emergency funds, paying off bad debt, or saving for retirement are at the bottom of the pyramid as the largest portion, to indicate most important. Next, as a slightly smaller portion, comes insurance and paying off good debt. Next and an even smaller portion on the pyramid is savings, investments and estate planning.

Finally, at the very top of the pyramid is the smallest portion, to be given the least weight, splurging. Adhering to this simple and responsible way of spending is your first step in the right direction.

The key reason to choose Avantcard is this; they have the most comprehensive introductory offer out there on the market, with 3, that’s right 3 interest free offers in one card.

Called the 3-8-9 offer, there is 0% interest on any purchases you make with the Avantcard for the first 3 months. In fact, we’re here to tell you that Avantcard have an exclusive offer launching this month. Avantcard is increasing it’s 0% Balance Transfer from 6 months to 8 months this month and running for a limited time only.

That’s right, you can literally start your new year with a financial waistline that is size 0%. This is an excellent opportunity for you to pay off any existing credit card bill and then you would not have to pay a cent in interest for the first eight months.

An additional benefit is Avantcard’s 0% interest on money transfers offer which gives you the option to transfer extra cash into your current account interest free for nine months! Essentially that is an interest free loan, provided you pay it off within that time and make the minimum monthly repayments. Paying with Avantcard also means you don’t need to waste time queueing at ATMs to take out cash, and being charged bank fees and government stamp duty for every cash withdrawal.

And if you use your debit card at point of sale, additional bank charges may apply also and this is on top of regular account maintenance fees. Why waste your time with this when you can use your Avantcard and benefit from their fantastic 3-8-9 offer? Did we mention it also gives you 4% cashback with Booking. com?

Ringing in the new year with healthy finances and an excuse to book an affordable holiday sounds like a great kickstart to 2018 to us! All you need to do is visit www.avantcard.ie, apply online following their easy step by step process, submit the correct documents and you could have your Avantcard within a week. The website even has an eligibility checker that will tell you kind of credit limit you might be eligible for.

However, if you would prefer to speak to an advisor you can do that too. The award winning consumer credit team (Consumer Credit Team of the Year by ICMT) are based in Carrick-On-Shannon in Co. Leitrim so your kickstart to financial health is just a phone call away, (071) 950 4076.

Before you make your decision, consider your options and your funds and decide if it is the best financial plan for you. Good luck, and Happy New Year.

To apply online for a personal loan up to €75,000, or for a credit card with 0% interest on purchases, balance transfers and money transfers* click here today!

*0% interest on purchases for 3 months, balance transfers for 8 months, and money transfers for 9 months.

The new Avantcard credit card is only available to new customers over the age of 18. Lending criteria, terms and conditions will apply. Available to residents of the Republic of Ireland and subject to repayment capacity and financial status. Proof of income and a credit reference agency search will be required to help approve your request. You’ll need to pay your minimum monthly repayment on time each month and stay within your credit limit to keep your promotional rates. When the promotional offer ends any outstanding amount will be charged interest at your standard variable rate.

Standard purchase interest rate of 16.8% variable. Typical APR (Annual Percentage Rate) 22.9% includes Government Stamp Duty of €30. Assuming credit limit of €1,500 repaid in equal instalments over 12 months, total amount repayable by customer is €1,636.50. Total cost of credit of €136.50.

Avantcard DAC trading as Avantcard is regulated by the Central Bank of Ireland.